Crypto Markets Dip as Trump Shifts on Iran-Israel Peace Talks

This week, markets moved a lot because of a political twist that shook up global sentiment. Donald Trump, the former president of the United States, publicly denied any involvement in the ongoing peace talks between Iran and Israel. This change shocked both the political and financial worlds. The crypto market, which is known for quickly responding to global uncertainty, was no different. Bitcoin, Ethereum, and a few other popular altcoins fell as traders thought about what it meant for diplomatic progress to break down or even just stop.

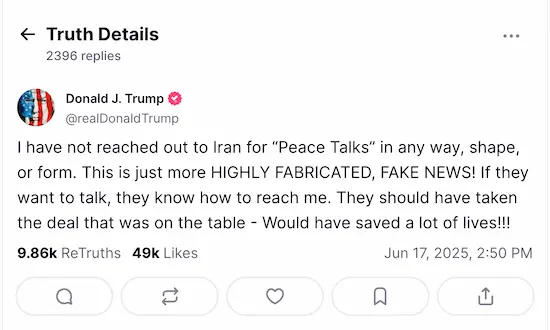

The episode began with media speculation that high-profile people, including Trump, were helping to set up secret talks. However, he swiftly refuted the story, calling the reports “completely fake” and denying any involvement.

This sudden change happened at a time when both traditional and digital markets were looking for signs that geopolitics was getting cooler. Instead, they got the opposite.

Crypto traders quickly took the instability into account. Bitcoin fell from recent highs and is now close to the $106,000 level. Ethereum did the same thing, testing support levels close to $2,500. These drops may not seem that big on their own, but they were followed by more than $360 million in long position liquidations across exchanges. This shows how leveraged and sensitive the current crypto market is.

Geopolitics and the volatility of cryptocurrencies are still linked.

The pattern is clear, and becomes increasingly familiar with each new global flashpoint. When there is a chance of conflict or things are unclear, the crypto markets shake. People often call digital assets “uncorrelated,” but in the short term, they often act like traditional risk assets. Traders get out of positions with a lot of volatility, unwind their leverage, and look for safety in cash, gold, or short-term government bonds.

This week’s drop is very telling. It wasn’t caused by tech news, blockchain failures, or basic facts. One person’s statement denying involvement in peace efforts sparked it. Still, the effects spread to other exchanges. That shows how closely tied crypto is to the bigger picture of geopolitical risk.

This also means that cryptocurrency may be entering a new stage of growth. It is no longer immune to big shocks; it is now part of the macro conversation. Blockchain markets now sit alongside global investors, closely monitoring real-time global events such as oil price speculation, election cycles, and peace talks.

Crypto traders should be ready for more ups and downs as the situation in the Middle East changes and Trump’s role (or lack of one) becomes clearer. The market might bounce back once things calm down, but digital assets won’t be able to exist in a vacuum anymore.

Also read: Cardano’s Tango with Argentina: A Blockchain Dream in Motion