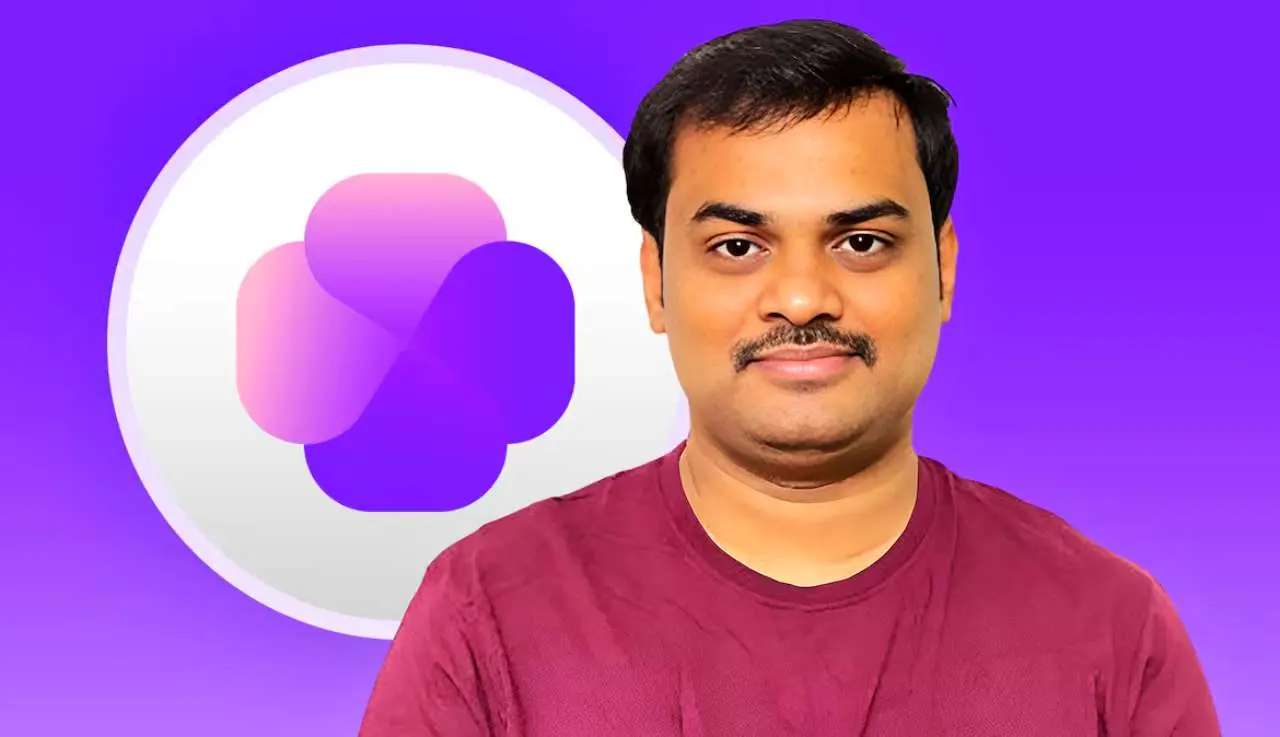

Self Chain CEO Axed After $50 Million OTC Scheme Allegations

Self Chain, a Layer 1 blockchain that is listed on Binance, has quickly moved to distance itself from a scandal that is starting to grow. Ravindra Kumar, the company’s former CEO, is accused of planning an over-the-counter fraud that allegedly stole $50 million from investors through Telegram deals. After the shocking claims, the Self Chain leadership said that Kumar has been completely removed from his job and will no longer have any duties or responsibilities on the project.

The claims are based on Kumar’s supposed involvement in deals that weren’t approved. He says the accusations are completely false and denies them. But the leaders at Self Chain have acted quickly. The team made it clear in a post on X that no founding members were ever allowed to make deals like this. To

They stressed that Self Chain did not approve of or allow any transactions to take place in the market. The statement gives the community peace of mind that the project’s roadmap and ongoing work will continue as planned, even though things have been disrupted.

Inside the Allegations and Leadership Shakeup Reports say that Kumar set up OTC deals off the books and asked for large sums of money through Telegram without getting permission from the company. The fallout has led to a complete change in leadership. A second X post from Self Chain says that the current team still has full control over operations and ethics and that the incident won’t stop the project’s goals from being met.

From the perspective of the community, the move is meant to keep credibility. Unauthorized OTC deals, especially those that involve digital assets from a listed platform, are very risky for both the business and the law. Self Chain wants to reassure investors and other interested parties that this kind of behavior won’t be allowed by firing Kumar and publicly condemning the deals.

What This Means for Blockchain Governance and Investors

The Self Chain case brings up bigger issues with over-the-counter (OTC) trades in the crypto world. These deals that take place outside of the market are often not clear and can lead to big losses for those involved if they are led by dishonest people. It also makes you wonder how blockchain projects check out their leaders and make sure that there are good internal controls in place for token distribution and private sales.

For investors, it’s a reminder to look at protocols not just for their technology or token economics, but also for their governance and compliance infrastructure. To stop unauthorized fundraising or asset diversion, projects need strong systems like multisignature wallets, recorded token sale histories, and public oversight.

Self Chain’s quick response could set a standard for how to be responsible in the space. They show their commitment to clean governance by clearly denying the alleged fraud, firing the CEO, and taking back control. It is still unclear how the legal issue will be resolved and whether investors will file charges or ask for money back. The blockchain community will be keeping a close eye on what regulators or investor groups do next.

Also read: OG Meme Coins Losing Their Mojo?